The launch early in February this year of Australia’s first unlisted fund to be quoted on the ASX, by Magellan group and its administrator, Mainstream, took a while to sink in, not helped by the dislocation caused by the pandemic crisis.

But, as Australia at least, is preparing to get back to business at some stage within the next six-or-so months, so have fund managers been studying their new option to reach the great, largely untapped, market of the self-directed unadvised self-managed super fund (SMSF) trustee.

The arrival of the Quoted Fund is set against a background of growing concerns by investors about LICs and LITs continually trading at discounts to their NAVs and the preference by managers to avoid those discounts. The new quoted fund regime, with both ASX and Chi-X, provides the benefits of a fund trading at or close to NAV, intra-day, being open-ended to make for easier expansion in FUM, and less costly for both manager and investor to access and hold.

Harvey Kalman, Equity Trustees’ global head of business development for fund services and managing director, UK and Europe, said: “This is very exciting stuff because it gives managers the opportunity for a dual registry. It represents another platform for their distribution… And it means that investors can choose the platform they want, not the product provider.” Equity Trustees has two managers ready to go to the market very soon, one of which will be quoting four funds.

The issue of discounts to NAV is common among LICs and has prompted at least one manager, Geoff Wilson’s Wilson Asset Management, to force some consolidation in that market segment. Wilson has two concurrent takeover proposals on the go – one for the Contango Income Generator and one for the Concentrated Leaders Fund. But with quoted funds, that issue is solved by the market itself.

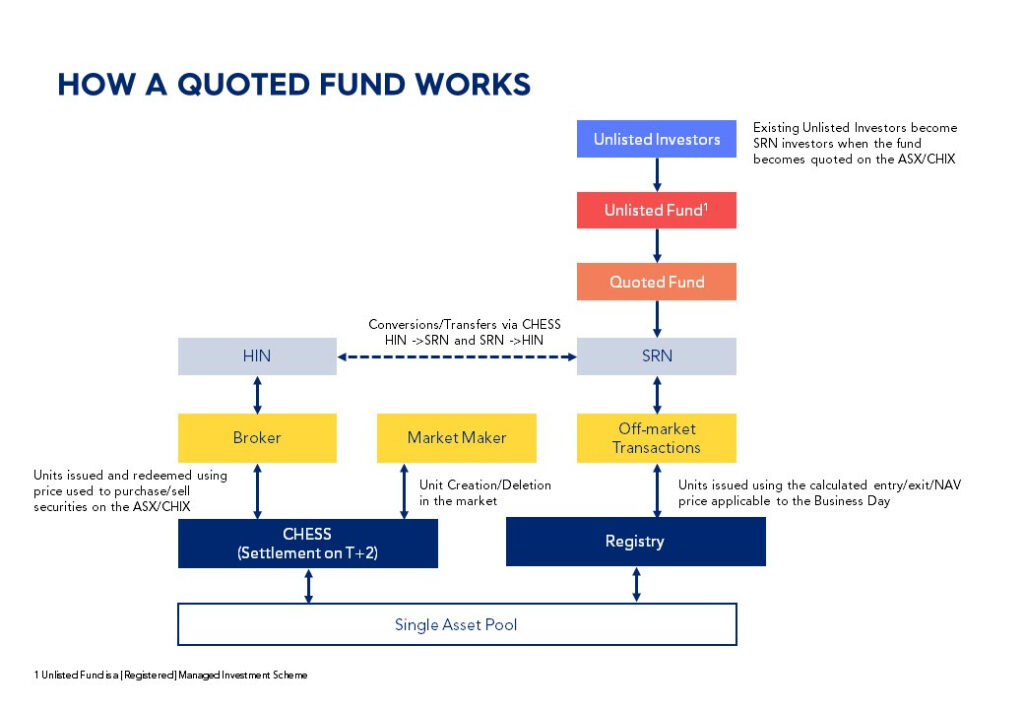

Kalman says that, if the ASX-quoted investment drifts away from its NAV, investors can switch out of that and into the unlisted fund, through their HIN holding, which will have the correct NAV on an intra-day basis. “This should keep the listed class in line because of the arbitrage,” he said.

On the costs involved, Kalman said that the manager would still need to have an unlisted unit trust structure to start with, which might involve a six-figure legal bill, provide a market-maker and pay exchange fees and regulatory fees. For investors, the manager’s product can be accessed through online and full-service brokers, which have little-or-no holding costs, low transaction costs and less paperwork than the traditional managed fund access system. Kalman says it may put some pressure on other platforms to reduce their fees.

At the time that Magellan’s Airlie fund became the first quoted fund, pre-pandemic status for COVID-19 and the March sharemarket fall, Martin Smith, the global chief executive of Mainstream Group, predicted that they probably had stolen a march of only about three months on the competition. That proved to be too conservative a view but the door is now wide open for everyone.

Equity Trustees sent a letter to clients last week (October 1), saying that the new distribution channel comes at a time when trading volumes continue to surge. It points to the latest ASX Investor Study which estimates that 900,000 Australians say they plan to buy listed investments for the first time within the next 12 months.

“Dedicated listed vehicles such as exchange-traded funds or listed investment companies attract large legal and listing fees. Raising capital is now harder, following new laws banning sales commissions to advisers and brokers,” the client letter says from the manager’s point of view.

Kalman estimates that the FUM required for a quoted fund to breakeven after costs to be between $25 million and $50 million, depending on the fund’s expense ratio. He says it takes between three and five months to get a fund to the point of listing.

The client letter says: “Quoted funds are the next evolution of managed funds, bringing greater value, convenience and transparency to managers and their clients.” Equity Trustees has produced a flowchart on how the system works: