Last year, one of Australia’s leading investors and fund managers walked into my office for a recording of The Australian Investors Podcast.

I had just been scribbling some notes on my whiteboard about philosophy, discount rates and practical aspects of investing in high growth companies for the long run.

He saw some of my chicken scratches, turned to me and said, “we don’t spend anywhere near enough time on this stuff as I’d like.”

In part one of this mini-series, Rask’s 10 rules for stock market investing, I revealed how a decade of research, education, experience and interviewing Australia’s top investors had molded my investment philosophy. In this article, I’m going to tell you how to implement the ideas I put forward in that article.

What I’m about to say will be 10x more profound if you read Part One first. Click here to open the previous article in a new browser tab.

Investment process: the Core & Satellite approach

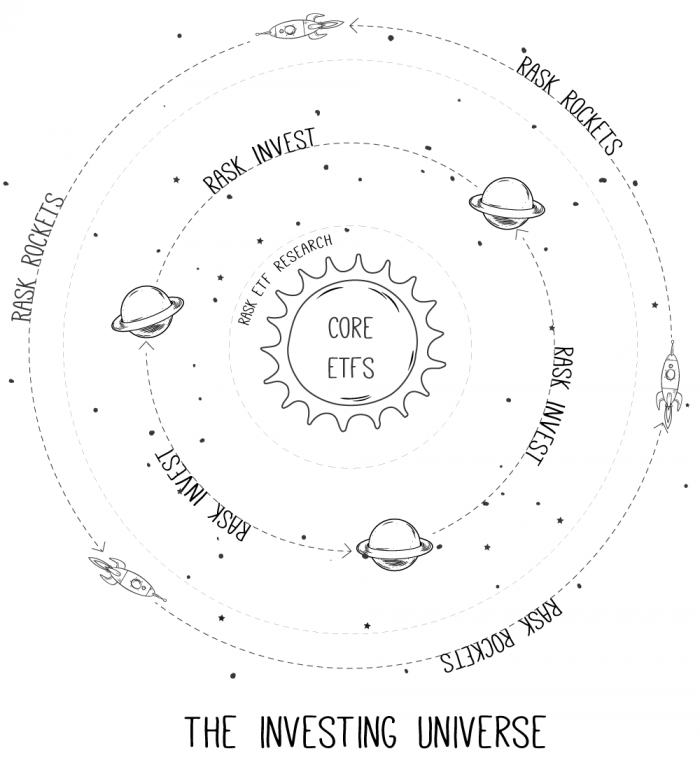

If investment philosophy is the ‘why’, the investment process is the ‘what’. What you actually do to express your investment philosophy and make money. I’ve met many investors who would benefit immensely from following a very simple and effective framework for investing. At Rask, we tell our members to consider using a ‘Core’ and ‘Satellite’ investment process for long-term wealth creation because it is intuitive, limits risk and provides upside. We have designed all of our premium membership services to reflect this framework for investing, not just in shares/equities but across other asset classes.

It starts with the Core

The ‘Core’ of a portfolio is the centre of every investor’s universe. It’s where most investors should begin (and end) their investment journey. Venture too far away from the Core without the right knowledge and equipment and you’ll be lost forever. We believe the Core of a portfolio should be reserved for investments that are:- Proven (i.e. based on objective empirical evidence)

- Low-cost (for maximum compounding)

- Low turnover (for tax reasons), and

- Easy to understand (for the sleep-at-night factor)

Satellite & tactical positions

The Satellite or ‘Tactical’ part of a portfolio is the smaller part (or parts) that investors can reserve for their ‘active’ investing and riskier positions. We believe individual shares can produce the best returns for focused investors. That said, a long-term time horizon (10+ years) and high-conviction approach, driven by deep research and valuation work, are essential for success. Patience in buying is important. Patience in holding is vital. Our Rask Invest membership service is our premium share research service which seeks to identify and recommend only the most impressive companies currently valued over $250 million in market capitalisation from both the ASX and global markets. To identify individual Satellite positions, our approach is as follows:- The companies must have a strong competitive advantage or ‘moat’

- Management must be aligned, talented, transparent and consider themselves as ‘owner-operators‘ (founders and families are great)

- The businesses must be within our team’s circle of competence (i.e. what we can understand). Given our expertise lies in the technology, finance, software and industrial sectors, we almost never venture outside of these industries. Fortunately for us, the companies in these industries can be extremely profitable.

- The business must operate in a structurally growing and increasingly important sector, market or geography. The total addressable market (TAM) is very important when we are aiming to invest for 5-10 years or more.

- The shares/business must be reasonably valued. We will use the standard valuation modelling tools, such as discounted cash flow (DCF) analysis, internal rate of return (IRR), comparables and ratios, and sum-of-the-parts.